Silver Price Per Gram

Silver, a precious metal that has been used as currency for thousands of years, is highly sought after and its value often fluctuates. As the price of silver changes on a daily basis, many people are interested in understanding the factors that influence its value.

In this article, we will explore the historical price trends of silver, and how these may affect current prices per gram. Additionally, we will provide advice on tips for buying and selling silver to help maximize profit potential.

So buckle up for an informative journey through the fascinating world of silver pricing!

Factors that Influence the Price of Silver

Factors that have an impact on the cost of precious metal are explored in this section.

Silver prices are affected by a number of economic, political, and market forces.

Inflation has a direct effect on the price of silver. As inflation increases, so does the price per ounce of silver.

Additionally, the demand for silver is also a major factor in affecting its price; when there is more demand for silver than what is available supply, then its price rises as well.

Other factors such as geopolitical events can affect the price of silver too; if there is uncertainty or instability in certain parts of the world, investors may be more inclined to buy gold or other precious metals instead of stocks or bonds which could result in increased demand for silver and higher prices as well.

Finally, speculation on future prices by traders and investors can also influence current spot prices for silver; if traders think that it will increase in value over time they may invest heavily which can lead to a spike in buying activity and an increase in its value.

Historical Price Trends of Silver

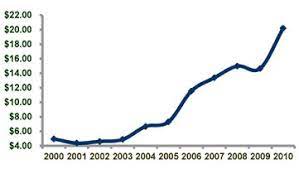

Analyzing historical trends of the precious metal can provide insights into potential fluctuations in its value, such as when the economic downturn of 2008 caused an increase in demand and therefore a spike in prices. Since then, the price of silver has seen a steady rise.

In 2011, it was at its highest level since 1980 due to strong investor demand and a weak US dollar. However, there have also been periods where silver prices were low due to factors such as market uncertainty or oversupply.

For example, during the coronavirus pandemic, investors shifted their focus away from commodities which led to lower prices for silver. This highlights how important it is to consider various external macroeconomic conditions when assessing price trends for this commodity.

Latest Silver Price per Gram

The current rate of silver per gram provides an indication of its value in the market. Silver is a precious metal, and its price fluctuates according to global supply and demand. As with all commodities, there are many factors that affect silver prices, such as:

- Political instability or economic downturns

- Currency fluctuations

- Industrial demand for silver products such as coins, jewelry, and electronics

- Investment demand from large buyers looking to capitalize on short-term price movements.

Currently, the spot price of silver is around $17.50 per troy ounce (31 grams). The spot price reflects the current trading level of silver in the international market at any given time; thus it can change drastically in a matter of minutes due to new information or events concerning supply or demand for silver worldwide.

Investors often use futures contracts to speculate on future prices by locking in their purchase at a set date and price; however this comes with additional risk since they may be unable to sell their investment if prices decline below what they paid for it during the contract period.

Tips for Selling Silver

Selling silver is a complex process that requires careful consideration of several factors to ensure the best outcome. Before selling, it is important for an individual to determine the current silver price per gram in order to know how much money they can expect from their sale. This can be done by researching online or consulting with a professional appraiser. It is also important for sellers to understand what type of silver they are selling and its current condition. Depending on the quality and quantity being sold, different methods may be used such as auctions, trading platforms, or private sales.

| In order to maximize profits when selling silver, there are several key tips that should be followed. | Tip | Explanation |

|---|---|---|

| Research Prices | Knowing the latest prices will help individuals get the most out of their sale. | |

| Know Your Silver | Understand what type of silver you have and its condition before attempting a sale. | |

| Choose Proper Platforms/Auctions | Different platforms may offer better deals for certain types of silver depending on quality or quantity being sold. |

By following these tips, individuals looking to sell their silver can ensure that they receive the best possible deal for their sale while avoiding any potential pitfalls along the way.

Tips for Buying Silver

When looking to buy silver, it is important to be aware of the various factors that can affect the price and quality. The current market value of silver should always be considered when making a purchase. Silver prices are typically based on the spot price, which fluctuates daily due to changes in supply and demand. Therefore, buyers should keep an eye on current market trends and make sure they are getting a fair price for their purchase.

In addition to market prices, other factors such as size, weight, purity level (measured in karats), and type of product (coins or bullion bars) can also affect the cost of purchasing silver. It is important to research these different aspects before making any purchase so that buyers can be confident they are getting a good deal.

Reputable sources such as coin dealers or precious metal exchanges can help ensure buyers receive quality products at fair prices.

Frequently Asked Questions

What type of silver is most valuable?

Silver is a precious metal that has been used for coins, jewelry, and other objects of value for thousands of years.

It is also an important industrial metal, with many uses in electronics, medicine and other fields.

Silver is considered one of the most valuable metals due to its rarity, malleability and ductility.

The type of silver that is most valuable depends on several factors, including its purity or fineness (determined by how much silver there is compared to other alloys), the demand for it from industry and collectors, and its form or shape (such as bars or coins).

What is the relationship between silver and gold prices?

The relationship between silver and gold prices is often seen as an indicator of the global economic environment. Both precious metals have long been considered storehouses of value, and their prices trend inversely with risk appetite.

Silver tends to be more volatile than gold, meaning that it is subject to higher peaks and lower valleys compared to gold. The price of silver usually moves in tandem with the price of gold, tracking closely with changes in its relative valuation.

As a result, when the price of gold goes up, silver generally follows suit; conversely, when the price of gold falls, silver often follows too.

What are the benefits of investing in silver?

Investing in silver can be a financially beneficial decision as it is seen to yield a higher return than other precious metals, such as gold.

Silver prices are impacted by inflation and supply/demand factors, making them more volatile than gold prices. This volatility means that investors may be able to take advantage of short-term price movements and make significant profits.

Additionally, the cost of investing in silver is much lower than for gold due to its affordability and availability, meaning investors can diversify their portfolio with less money.

Finally, silver is seen as an important part of any investment portfolio because it acts as a hedge against inflation and economic uncertainty.

Are there any risks associated with investing in silver?

Investing in silver can be a lucrative endeavor, but it is important to understand that there are risks associated with this type of investment.

Such risks include the potential to lose money if the price of silver changes suddenly and unexpectedly. Investing in silver requires careful consideration and research as prices can go up or down unpredictably due to factors such as supply and demand, government policies, or economic conditions.

Additionally, physical storage costs may need to be factored into the equation when investing in silver since most investors prefer to keep their metal secure in a safe location.

It is wise for any investor to understand both the benefits and risks associated with investing in silver before taking the plunge.

What is the best way to store silver?

Storing silver is an important process for investors. It should be done in a way that keeps the metal safe from theft, fire, flood, and other natural disasters.

Silver should be stored in a secure place such as a bank vault or home safe. Additionally, investing in tamper-proof packaging can help protect the silver from physical damage or tarnishing due to oxidation.

It is also important to consider the costs associated with storing silver if it is being kept in a professional facility; these costs should be weighed against the safety benefits of using such facilities.

Conclusion

The value of silver is determined by a variety of factors. From the historical price trends, to the current market conditions, and even the type of silver being purchased or sold; all of these elements come together to create the current per gram rate.

Silver should be handled with care as it can be a volatile investment. Just like a rollercoaster, silver prices can experience highs and lows in quick succession.

It is important for investors to research thoroughly before buying or selling any amount of silver. By doing so, they are more likely to make an informed decision that will benefit them in the long term.